At Oodles ERP, we provide extensive Odoo customization services to meet diverse business requirements. Apart from Odoo version 13, our development team is adept at working with Odoo versions 11 and 12. We have a powerful stack of 10,000+ supported Odoo applications to increase the flexibility and scalability of business processes.

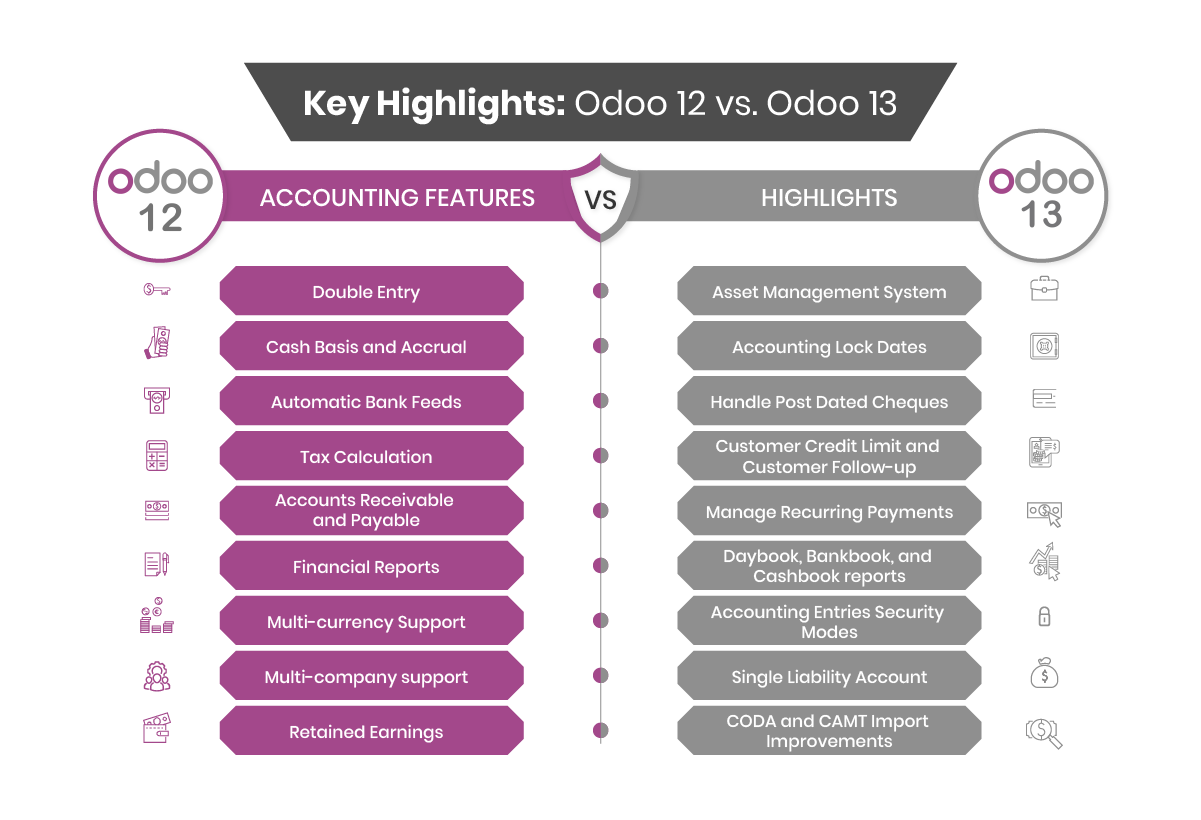

Odoo 12 Vs. Odoo 13 Accounting Module

Various accounting functionalities like budget, asset, and accounting reports were removed from Odoo version 12. But, Odoo 13 contains all the essential functionalities of accounting like asset management, PDC management, customer credit limit, bankbook, accounting reports, account lock dates, and cashbook reports.

Note: We provide Odoo implementation services to streamline and automate business processes. If you are interested in an Odoo implementation, feel free to contact us.

Updated Features in Odoo 13 Accounting Module

Recurring Entries:

An important feature of the Odoo 13 accounting module. It enables businesses to generate entries for specific periodical bills like rent or electricity bills. Businesses can set the recurring template for that bill and the time period for which it repeats. Once the recurring template is set, the bill will be posted or created automatically as a draft according to the recurring interval and recurring period.

To create a recurring template go to:

Accounting -> Configuration -> Recurring Template

After creating a recurring template, you need to fill the following fields:

* Name: Name of the recurring payment

* Pay Time: Specify whether the bill can be paid directly or will be paid later

* Recurring Period: Select the recurring period (days, weeks or months).

* Recurring Interval: Specify the recurring interval

* Starting Date: Specify the date for recurring payment

* Next Schedule: It is calculated on the basis of recurring period and recurring interval

* Amount: Mention the amount for recurring payment

Asset Management:

Using this module, businesses can manage their own assets or the assets of individuals. They can keep track of depreciation that occurred on those assets. Businesses can compute the depreciation based on three types of assets:

* Lock Dates: Businesses can set lock dates for non-advisors so that they are unable to make any changes in their accounts. Later, they can use this data at the time of auditing

* Generate Asset Entries: It enables businesses to automatically generate asset entries for an estimated time period.

* Reconciliation: It is an invoice-payment reconciliation that enables businesses to match the payment with corresponding invoices

Also Read: Benefits of Accounting Module in Odoo 12

Accounting Reports:

* Profit and Loss: It displays an organization's net income by deducting expenses from revenue for the reporting period

* Cashflow Statement: It shows how changes in balance sheet accounts and income affect cash equivalents

* Balance Sheet: It depicts data of an organization's asset, liability, and equity in the report including income statement and cash flow statement.

* Bank Book: It enables businesses to print the report of their bank transactions

* Day Book: It enables businesses to print everyday transactions in the report

Customer Follow-ups

For the growth of businesses, it is critical for the accounts department to collect the payments that are overdue and send appropriate reminders as per the due date. Odoo 13 enables businesses to set the follow-up levels and view follow-up reports of each customer whose payments are overdue.

Other Impressive Accounting Features of Odoo 13:

* SEPA: It is a back booking option that lets you define how single consolidated debit or multiple debits can be handled.

* Taxes: Odoo 13 has made the configuration of taxes easier. Now, the type of taxes is visible in tax mapping. It also includes periodical closing with lock date.

* CODA and CAMT Import Improvements: Odoo 13 enables businesses to import multiple files at once for better efficiency

* Single Liability Account: If the balance of VAT transactions show a debt to the state at the end of the period, then it is combined into a single liability account. It enables businesses to meet deadlines and automate accounting entries.

Avail Benefits of Odoo 13 Accounting with Oodles

We are an ERP development company with more than 6 years of experience in customizing and implementing Odoo solutions to meet specific business requirements. We provide Odoo accounting services to streamline every order to cash and procure to pay process. Our services include PDC management, payment receipt, partner ledger, vendor payment methods, stock picking, and manual bank reconciliation.

Do you want to bring your store to Odoo 13? Send us your requirements and get the best Odoo implementation services from our seasoned ERP development team.

Read Next: Odoo ERP Implementation to Manage Business Efficiently